The Volatility Root Law – Part II: From Fractal Breakeven to Volatility-Defined Death

- July 20, 2025

- Posted by: Drglenbrown1

- Category: Quantitative Trading, Risk Engineering

Quantum Edition — In Harmony with Dr. Glen Brown’s Nine Laws

By Dr. Glen Brown

1. Introduction: The Quantum Breath of Volatility

In the realm of quantum physics, particles do not travel in straight lines. They evolve in probabilistic clouds, influenced by energy amplitudes and memory states. So too do trends in financial markets.

This paper completes the evolution of the Volatility Root Law, where temporal market memory (P) governs the safe volatility amplitude as:

Amplitude = √PFor P = 256, this gives us:

Sacred Amplitude = 16 × ATR₍₂₅₆₎This amplitude is the quantum field boundary—a “containment band” in which the trade wavefunction can evolve. Beyond it lies decoherence—trade death.

2. Fractal Breakeven Zones: Discrete Energy Layers of Profit Evolution

Just as quantum particles can only occupy discrete energy states, trades evolve through fractal breakeven zones—structured amplitudes that define stability thresholds.

Quantum Metaphor: Each ATR-multiplier band represents a quantized volatility shell—like the orbitals of electrons. A trade is “excited” to a higher shell (breakeven, trail) only when energy (volatility) permits.

| Zone | Energy Band | Action | Law Alignment |

|---|---|---|---|

| 1× | Ground State | No action – initial movement | Law 1: CRTL |

| 2× | First Excitation | Structure forming | Law 2: WDHDI |

| 4× | Critical Mass | Breakeven activation | Law 5: EOD |

| 8× | Energy Expansion | Trailing Stop | Law 6: ADBED |

| 16× | Decoherence Barrier | Final trailing stop | Law 4: E&DS |

3. Volatility-Defined Death: The Collapse of the Trade Wavefunction

In quantum systems, observation causes a particle’s probabilistic state to collapse into a single, observable outcome. Likewise, when volatility exceeds the safe amplitude, the trade wavefunction collapses—this is trade death.

Death Stop = 16 × ATR₍₂₅₆₎Exceeding this level indicates decoherence—exit is now mandatory.

- Law 4 (E&DS): Death only at structural collapse.

- Law 5 (EOD): Exit only on Death Stop or Breakeven state.

- Law 9 (CMV): Continuous renormalization of DAATS space.

4. Temporal Hierarchy & the Minimum Trade Lifetime Doctrine

Key Principle: To avoid trade death from evening compression on M1–M30, these timeframes must anchor their death logic to M60’s ATR₍₂₅₆₎.

Death Stop = 16 × ATR₍₂₅₆₎ (M60)Quantum Metaphor: M60 acts as a quantum shield—higher time coherence protects short-term trades from shallow, meaningless decay.

- Law 3 (MSPL): Short-term compression must defer to macro structure.

- Law 7 (PLBND): Risk budget allocated across time dimensions.

- Law 8 (TCSOL): Stop buffers applied via M60 volatility lens.

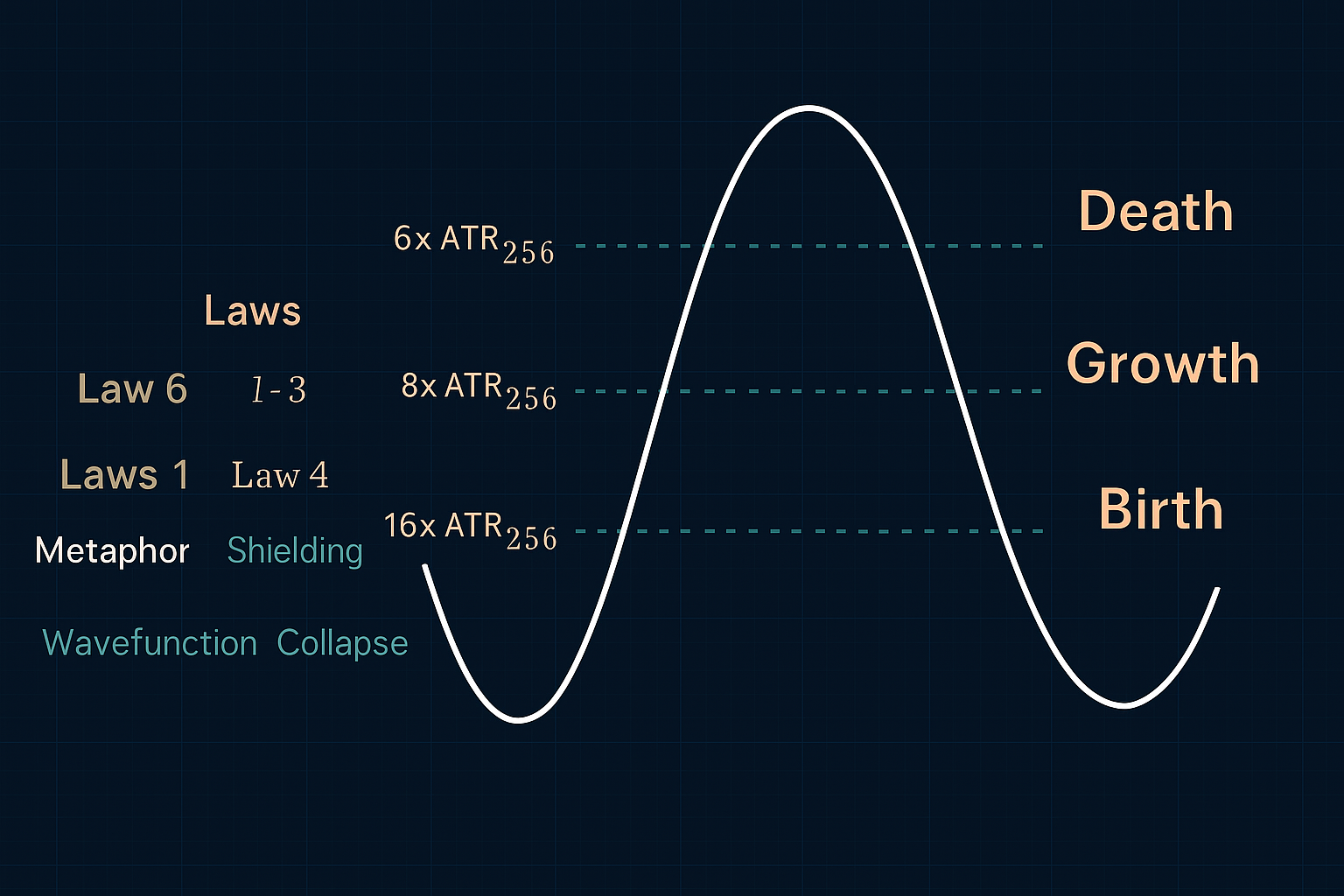

5. Lifecycle Map: Trade Evolution Through Quantum Time

The trade now evolves through quantized volatility states:

Birth: Entry → Volatility ≤ 4×ATR → Holding phase Growth: 4× < DAATS ≤ 8× → Breakeven activation 8× < DAATS ≤ 16× → Trailing begins Collapse: DAATS > 16×ATR → Wavefunction collapses → Exit

6. Philosophical Synthesis: The Sacred Containment of Chaos

“We transformed volatility into a sacred wave. We obeyed its cycles to manifest profits, and respected its expansion to preserve survival.”

Volatility now becomes a metaphysical medium:

- Volatility = Wavefunction

- Amplitude = Sacred Risk Envelope

- Breakeven = Energy Shift

- Death = Decoherence

Nine Laws Summary Matrix

| Law No. | Interpretation |

|---|---|

| 1 | Transition detected by volatility thresholds |

| 2 | Volatility memory decay controls dynamic scaling |

| 3 | Shock propagation deferred to higher timeframes |

| 4 | Death occurs only at volatility decoherence |

| 5 | Exit on death or break-even only |

| 6 | Breakeven decision by regime probability |

| 7 | Noise/risk budget assigned by timeframe |

| 8 | Stop buffering via temporal stop pads |

| 9 | Weekly DAATS rebalancing for adaptive rebirth |

About the Author

Dr. Glen Brown is the President & CEO of Global Accountancy Institute, Inc. and Global Financial Engineering, Inc. He is a financial engineer, algorithmic trading strategist, and developer of the Global Algorithmic Trading Software (GATS). With over 25 years of expertise in finance, accounting, and advanced trading systems, Dr. Brown bridges the gap between market mechanics and metaphysical insight. His frameworks—including the Nine Laws of Adaptive Volatility & Risk Management—pioneer quantum-inspired approaches to modern trading.

General Disclaimer

This publication is for informational and educational purposes only. It does not constitute investment advice, financial advice, or a solicitation to buy or sell any financial instrument. Trading and investing involve risk, and past performance is not indicative of future results. Readers are advised to conduct their own research or consult with a qualified professional before making any financial decisions.

Global Accountancy Institute, Inc., Global Financial Engineering, Inc., and Dr. Glen Brown assume no liability for any direct or indirect loss arising from the use of the information provided herein.