Understanding the Value-Zone Gap (VZG): A Deep Dive into Regime Shifts, Momentum & Fair Value

- April 30, 2025

- Posted by: Drglenbrown1

- Category: Technical Analysis / Trading Strategies

Introduction

In Dr. Glen Brown’s GATS framework, the Value Zone—defined by the 26-period and 50-period EMAs—serves as your dynamic “fair-value” corridor. How that corridor expands, contracts, or even inverts tells you everything you need to know about changing trend regimes and momentum strength. In this article we’ll:

- Define the Value-Zone Gap (VZG)

- Explain what happens when the gap flips, widens, or narrows

- Show how your MACD(26,50,8) mirrors each state

- Revisit the Volatility-Weighted Fair Value (FV) metrics that complement VZG

- Tie it all together into a clear trading playbook

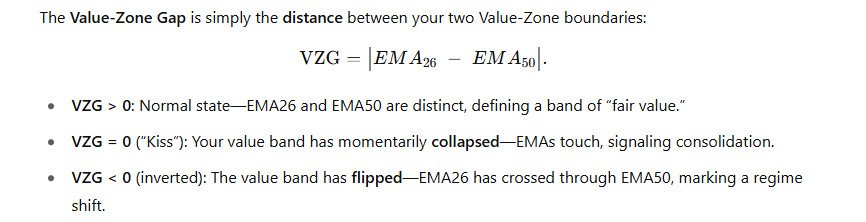

1. Defining the Value-Zone Gap (VZG)

The Value-Zone Gap is simply the distance between your two Value-Zone boundaries:

2. Three Key VZG States & Market Implications

| VZG State | EMA Behavior | Market Interpretation |

|---|---|---|

| 1. Gap Expansion | EMA26 & EMA50 diverge wider | Strong, accelerating trend; momentum building |

| 2. Gap Narrowing | EMA26 & EMA50 converge closer | Consolidation; momentum pausing |

| 3. Gap Flip | EMA26 crosses EMA50 (inversion) | Regime change; trend reversal or acceleration |

2.1 Gap Expansion

- What: VZG grows as EMA26 and EMA50 move apart.

- Why It Matters: Price is stretching out of fair value with conviction.

- MACD Behavior:

- MACD Line (EMA26–EMA50) moves further from zero.

- Histogram bars swell, showing rising momentum.

- Trade Playbook:

- Trend-Follow Entries on pullbacks to the inner band (EMA26).

- Trail stops behind the growing band; consider adding on minor retracements.

2.2 Gap Narrowing

- What: VZG contracts as EMAs draw together.

- Why It Matters: Momentum is fading; price is consolidating around the fair-value corridor.

- MACD Behavior:

- MACD Line flattens toward zero.

- Histogram shrinks, often oscillating across the Signal line.

- Trade Playbook:

- Avoid new trend entries until the gap re-expands.

- Mean-Reversion setups: price extremes beyond a tight band may snap back toward the FV midpoint.

2.3 Gap Flip (Value-Zone Inversion)

- What: EMA26 crosses through EMA50—inner and outer boundaries invert.

- Why It Matters: The medium-term trend (26-period) has overtaken the longer trend (50-period), signaling a regime shift.

- MACD Behavior:

- MACD Line crosses zero in the flip direction.

- Signal-Line cross ideally confirms the move.

- Trade Playbook:

- Bullish Flip: Only take longs; use former EMA50 (now support) as your stop reference.

- Bearish Flip: Only take shorts; former EMA50 (now resistance) sets your tight stop.

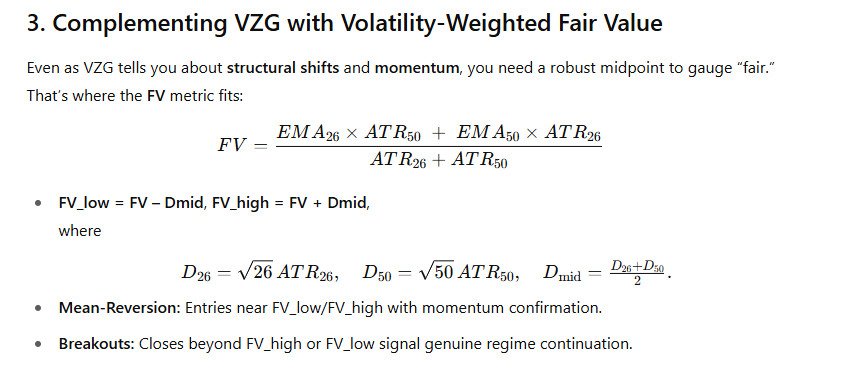

3. Complementing VZG with Volatility-Weighted Fair Value

Even as VZG tells you about structural shifts and momentum, you need a robust midpoint to gauge “fair.” That’s where the FV metric fits:

4. Unified Trading Playbook

- Monitor VZG Daily:

- Expansion → bias stays; look for trend additions.

- Narrowing → pause; switch to mean-reversion or sit on hands.

- Flip → reverse bias and re-anchor stops/targets.

- Use Daily MACD (26,50,8) as your master bias filter:

- MACD > 0 → bullish Value Zone (EMA26 > EMA50)

- MACD < 0 → bearish Value Zone

- Time entries on lower TFs (H4, M60, M30) only when they align with the Daily VZG state and Daily MACD bias.

- Overlay FV bands for precise mean-reversion and breakout thresholds in any regime.

About the Author

Dr. Glen Brown is President & CEO of Global Accountancy Institute, Inc. and Global Financial Engineering, Inc., and developer of the GATS framework. With over 25 years in proprietary trading, quantitative risk management, and algorithmic strategy design, he specializes in volatility-adaptive, multi-timeframe systems integrating ATR-based envelopes, fair-value metrics, and AI-driven signals. Dr. Brown holds a Ph.D. in Investments & Finance.

Risk Disclaimer

This article is for educational purposes only and does not constitute financial advice or an offer to trade. Trading financial instruments involves significant risk, and you may lose more than your initial investment. Past performance is not indicative of future results. Always conduct your own analysis and consult a qualified financial advisor before making trading decisions. Neither Dr. Glen Brown nor Global Accountancy Institute, Inc. accepts liability for trading outcomes.