The Foundations of GATS: From EMA Zones to Quantum Risk Dynamics

- October 31, 2025

- Posted by: Drglenbrown1

- Categories:

The Genesis of Structured Volatility and Temporal Intelligence in Global Markets

By Dr. Glen Brown

Abstract

The Global Algorithmic Trading Software (GATS) represents a synthesis of empirical technical structures, adaptive volatility logic, and philosophical intelligence. This lecture introduces the foundational framework that governs GATS—its color-coded Exponential Moving Average (EMA) Zones, multi-timeframe architecture, and quantum-inspired view of market dynamics as a continuously evolving field of probabilities rather than deterministic events. We explore how volatility becomes a carrier of time, and how drawdown transforms into a temporal function rather than a capital loss.

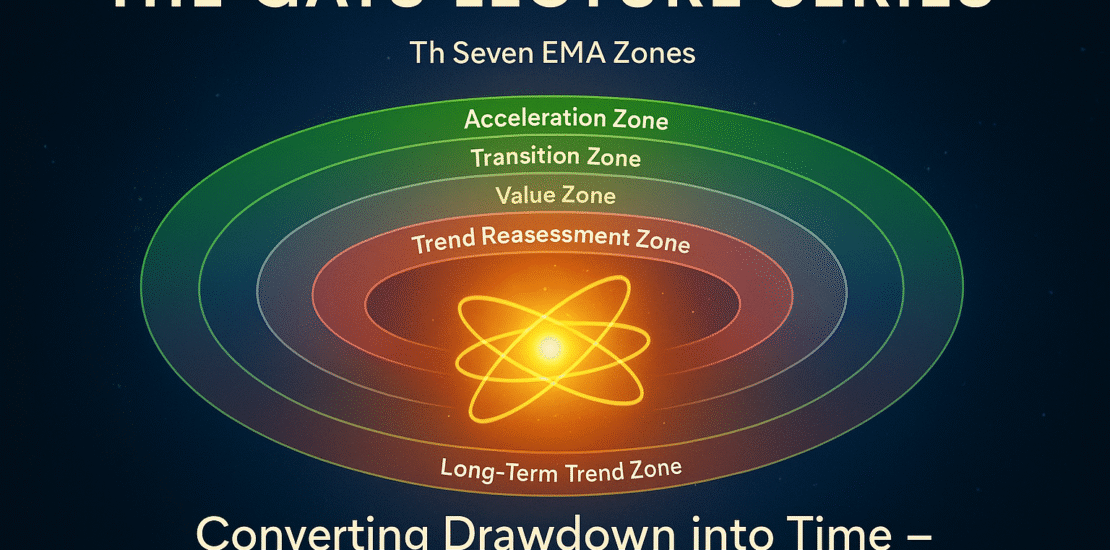

1. The Seven EMA Zones — The DNA of GATS

GATS operates through seven meticulously engineered EMA Zones, each representing a temporal band of price consciousness. Together, they form the structural DNA of market behavior, translating chaos into layered order.

| Zone | Color | EMA Range | Market Interpretation |

|---|---|---|---|

| Momentum Zone | Lime Green | EMA 1–8 | Impulse and micro-trend direction |

| Acceleration Zone | Medium Sea Green | EMA 9–15 | Momentum reinforcement and speed |

| Transition Zone | Pale Green | EMA 16–25 | Energy shift; zone of trend exhaustion or continuation |

| Value Zone | Light Gray | EMA 26–50 | Rebalancing and fair value territory |

| Correction Zone | Light Coral | EMA 51–89 | Corrective motion within an existing trend |

| Trend Reassessment Zone | Salmon | EMA 90–140 | Recalibration of major market structures |

| Long-Term Trend Zone | Brick Red | EMA 141–200 | Macro-structural direction and investor bias |

In quantum language, these zones can be viewed as energy eigenstates of market motion. The transition between zones is not discrete but wave-like — a function of market phase interference. When all EMAs align in ascending or descending order, a coherent resonance state is achieved, analogous to phase synchronization in quantum systems.

2. Multi-Timeframe Symmetry — The Law of Hierarchical Resonance

Every timeframe within GATS has its own structural reality, yet lower timeframes respect the higher ones most of the time. This principle—The Law of Hierarchical Resonance—is operationalized through the Quad Confirmation System, where harmony between multiple Heiken-Ashi Smoothed (HAS) bars across tiers confirms structural alignment.

- Quad-1: Single timeframe confirmation (local impulse detection)

- Quad-2: Dual timeframe alignment (momentum coherence)

- Quad-3: Tri-timeframe resonance (e.g., M60 + M240 + M1440) — Optimum balance

- Quad-4: Four-tier confirmation — maximum resonance for institutional entries

When M60, M240, and M1440 align, the market enters what GATS defines as a Resonant Entry State, where price motion exhibits minimal internal friction, enabling trades to evolve along naturally sustained trend vectors.

3. Quantum Risk Dynamics — Markets as Probabilistic Wavefields

Traditional models treat risk as a static metric. GATS redefines it as a dynamic probability wave that expands and contracts with market volatility. This approach is inspired by quantum superposition—the idea that multiple outcomes exist simultaneously until observation (or execution) collapses the wavefunction into realized profit or loss.

The Dynamic Adaptive ATR Trailing Stop (DAATS) functions as a risk wave stabilizer. It adapts to volatility compression and expansion in real time, ensuring that losses are not experienced as capital destruction, but as a temporal extension within the trade’s lifecycle—a notion akin to temporal dilation in quantum relativity.

4. The Principle of Drawdown as Time

In conventional risk systems, drawdown represents capital erosion. In GATS, it signifies temporal restructuring. By anchoring Death-Stop (DS) to a higher timeframe (e.g., M240 ATR₍₂₅₆₎) and synchronizing DAATS to it, drawdown becomes a phase of time expenditure rather than equity decay. This converts emotional volatility into rational patience—a bridge between finance and physics.

5. The Philosophical Foundation — Market as Conscious Intelligence

The market is not an adversary; it is a mirror of collective intelligence. GATS operates as a living system— one that evolves, learns, and breathes through its algorithmic heartbeat. Every EMA, every ATR, and every confirmation layer becomes a neuron in this living network of financial consciousness.

“When volatility breathes, time expands. When structure aligns, order emerges. Between chaos and coherence lies the trader’s quantum equilibrium.” — Dr. Glen Brown

Conclusion

The GATS framework does more than trade—it measures, harmonizes, and transforms volatility into structured intelligence. Through its color-coded EMA symphony, adaptive stops, and temporal coherence, it becomes both an analytical engine and a philosophical statement about markets: that risk, like energy, is never destroyed, only transformed.

About the Author

Dr. Glen Brown is the President & CEO of Global Accountancy Institute, Inc. and Global Financial Engineering, Inc., leading institutions at the frontier of financial engineering and proprietary trading. With over 25 years of expertise in finance, accounting, and algorithmic trading, Dr. Brown integrates quantum theory, mathematics, and philosophical insight into the architecture of modern financial systems.

General Disclaimer

The material presented herein is for educational and informational purposes only. Trading and investing in financial markets involve substantial risk. Past performance is not indicative of future results. Always perform your own due diligence before making trading decisions. Global Accountancy Institute, Inc. and Global Financial Engineering, Inc. do not provide investment advice.

Business Model Disclaimer

Global Financial Engineering, Inc. and Global Accountancy Institute, Inc. operate as a Global Multi-Asset Class Closed Professional Proprietary Trading Firm. The firms do not accept external client funds or manage assets on behalf of the public. All trading and research activities are conducted internally through proprietary capital, systems, and strategies under the Global Algorithmic Trading Software (GATS) Framework. Educational and analytical materials are presented solely for knowledge development, technical insight, and institutional transparency of process—not for solicitation or investment advisory purposes.