-

WTI Crude Oil “Multi-Frame Confluence Blueprint”

- May 19, 2025

- Posted by: Drglenbrown1

- Category: Trading Strategies

No Comments

Discover the WTI Crude Oil “Multi-Frame Confluence Blueprint”—a step-by-step guide combining daily, 4H, and 1H EMA zones, MACD, oscillators & tactical trade plans.

-

NVIDIA (NVDA) Daily “Precision Breakout Blueprint”

- May 19, 2025

- Posted by: Drglenbrown1

- Category: Trading Strategies

Discover the NVIDIA Daily “Precision Breakout Blueprint” with the GATS framework—EMA zones, MACD, oscillators & tactical trade plan for NVDA.

-

S&P 500 Daily “Broad Bull Momentum Blueprint”

- May 19, 2025

- Posted by: Drglenbrown1

- Category: Trading Strategies

Explore the S&P 500 Daily “Broad Bull Momentum Blueprint” using our proprietary GATS framework—EMA zones, MACD, oscillators & tactical trade planning.

-

Gold Daily “Resilient Bull Under Pressure Blueprint”

- May 19, 2025

- Posted by: Drglenbrown1

- Category: Trading Strategies

Discover the Gold Daily “Resilient Bull Under Pressure Blueprint” using the GATS framework—EMA zones, MACD, oscillators & tactical trade planning.

-

Adaptive Breakeven Triggers for Index CFDs on M30 Part 1

- May 16, 2025

- Posted by: Drglenbrown1

- Category: Algorithmic Trading, Index CFDs

Uniform 8,073.06 DAATS-unit breakeven trigger for 19 index CFDs on M30 timeframe.

-

Global Top 14 Stocks to Watch

- May 16, 2025

- Posted by: Drglenbrown1

- Category: Equity Momentum, Trading Signals

A systematic approach combining population volatility and cost floors to lock in momentum-driven stock moves.

-

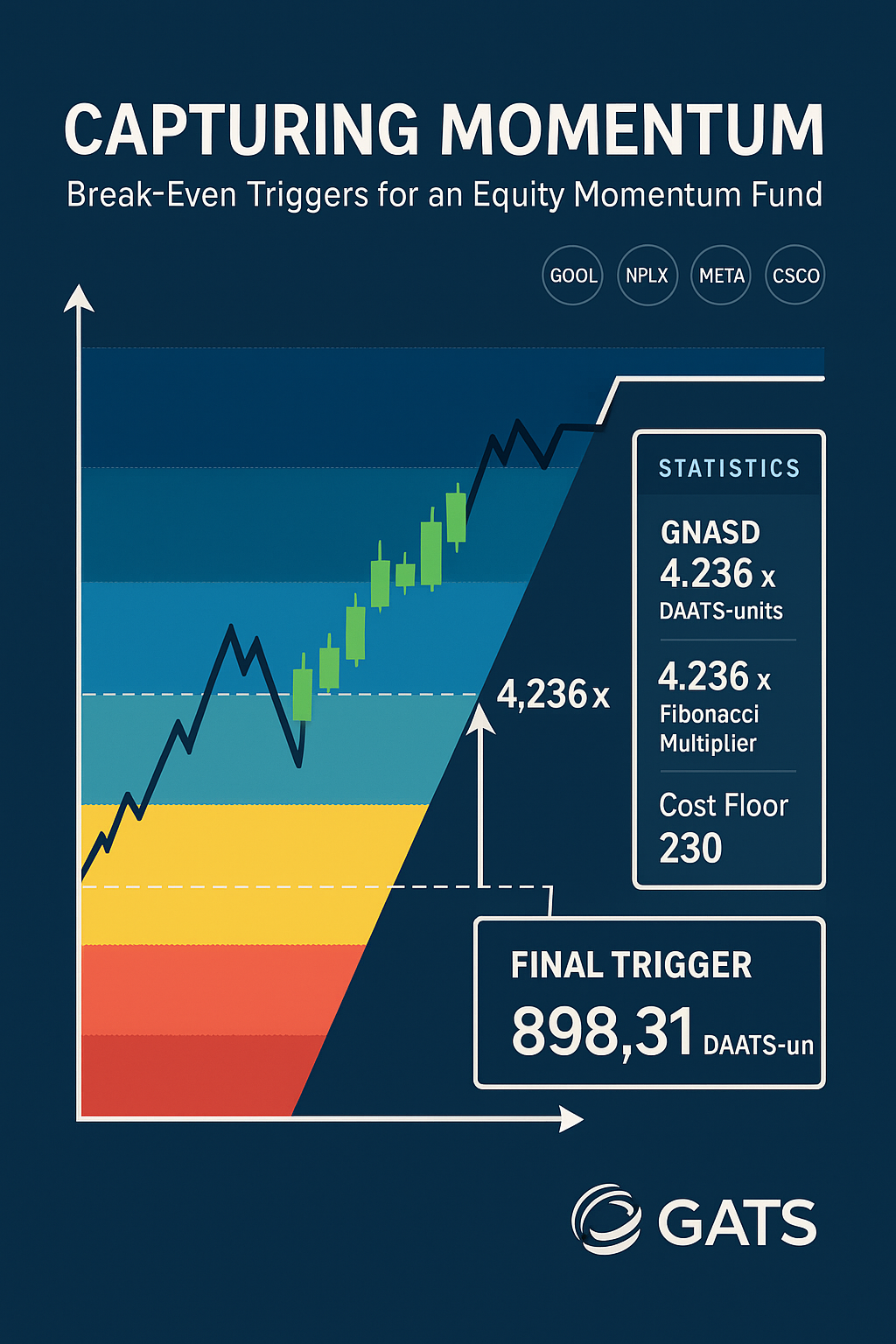

Capturing Momentum: GEMF USA Sub-Fund Adaptive Breakeven Model on M60

- May 16, 2025

- Posted by: Drglenbrown1

- Categories:

A systematic approach combining population volatility and cost floors to lock in momentum-driven stock moves.

-

Capturing Extreme Swings: A GNASD-Enhanced GASBET Framework for Adaptive Breakeven Stops on M60

- May 15, 2025

- Posted by: Drglenbrown1

- Categories:

An adaptive framework combining population volatility with Fibonacci multipliers to set practical breakeven stops on M60 charts.

-

Introducing the Global Tokenized Leverage Framework (GTLF): A New Paradigm for Internal Capital, Margin, and Risk Management

- May 13, 2025

- Posted by: Drglenbrown1

- Category: Financial Engineering

Introducing GTLF – an off-chain, tokenized model for capital unitization, programmable margin, and leveraged exposure within a closed-loop trading ecosystem.

-

GNASD-Enhanced GASBET: A Timeframe-Adaptive Break-Even Framework

- May 8, 2025

- Posted by: Drglenbrown1

- Categories:

An adaptive break-even framework using per-instrument SD, √time scaling, and Fibonacci multipliers—fully integrated into GATS.

-

Rebirth Through Transformation: How Consuming the Old Fuels Next‑Level Trading

- May 8, 2025

- Posted by: Drglenbrown1

- Categories: Algorithmic Trading, Trading Psychology, Thought Leadership

Learn why consuming old paradigms fuels innovation in proprietary trading and how to apply GATS, MEMH, and GASBET in your strategies.

-

GASBET: The Global Adaptive Statistical Break-Even Trigger

- May 6, 2025

- Posted by: Drglenbrown1

- Category: Algorithmic Trading / Risk Management

Explore the DAATS distance distribution, the GASBET

𝜅

𝜎

κσ trigger formula, visualization techniques, and trade-offs between manual and automated exits. -

Market Expected Moves Hypothesis (MEMH): Forecasting the Next Swing

- May 6, 2025

- Posted by: Drglenbrown1

- Category: Quantitative Finance / Risk Management

Explore MEMH’s statistical foundations, step-by-step expected move calculations, and case studies in equities & FX for disciplined target-setting

-

Dynamic Adaptive ATR Trailing Stops (DAATS): Volatilit-Scaled Exits

- May 6, 2025

- Posted by: Drglenbrown1

- Category: Risk Management / Algorithmic Trading

Learn how to deploy Dynamic Adaptive ATR Trailing Stops (DAATS) using ATR(89), square-root multipliers, and EMA zones to optimize trade exits.

-

Global Heiken-Ashi Smoothed (HAS): Candles that Clarify Trends

- May 6, 2025

- Posted by: Drglenbrown1

- Category: Technical Analysis / Algorithmic Trading

Explore the HAS algorithm, its smoothing logic vs. standard Heiken-Ashi, trend-color rules, and how it synergizes with color-coded EMA zones for clearer trading signals.

-

Color-Coded EMA Zones: Market Structure Across Timeframes

- May 6, 2025

- Posted by: Drglenbrown1

- Category: Technical Analysis / Algorithmic Trading

Explore GATS’s seven EMA zones—from momentum to long-term trend—color mapping, Fibonacci derivation, and actionable entry/exit cues grounded in market structure.

-

GATS Unveiled: Philosophy, Architecture & Core Principles

- May 6, 2025

- Posted by: Drglenbrown1

- Category: Algorithmic Trading / Financial Engineering

Explore the vision behind GATS: a transparent, adaptive, and modular algorithmic trading framework designed to harmonize indicators, risk controls, execution, and monitoring.

-

Global Clear, Transparent Stock-Selection Engine (GCTSE)

- May 4, 2025

- Posted by: Drglenbrown1

- Category: Quantitative Finance / Algorithmic Trading

Explore GCTSE’s end-to-end methodology—from daily EMA 8/50 alerts and momentum z-scoring to four-hour execution signals and GATS-aligned ATR stops—in a fully documented framework.