Dynamic Adaptive ATR Trailing Stops (DAATS): Volatilit-Scaled Exits

- May 6, 2025

- Posted by: Drglenbrown1

- Category: Risk Management / Algorithmic Trading

Objective: Walk through DAATS design—ATR period selection, multiplier logic, trade management.

Audience: Risk managers, execution traders.

Outline:

- ATR period choice (boundary zone rationale)

- k-multiplier via square-root rule

- Dynamic trail mechanics

- Best practices to avoid whipsaws

Introduction

Exiting a winning trade too early or too late can make or break performance. The Dynamic Adaptive ATR Trailing Stop (DAATS) is GATS’s solution for volatility-scaled exits, anchoring stop levels dynamically to current market conditions while respecting the structure defined by our EMA zones.

1. ATR Period Selection: Aligning with EMA Zones

- Correction Zone Boundary (EMA 51–89): Serves as the guideline for volatility measurement.

- ATR Period (N): We select N = 89 to match the upper boundary of the Correction Zone.

- Rationale:

- ATR(89) measures average true range over the same lookback as EMA-89, ensuring stops correspond to typical corrective swings.

- In volatile markets, ATR(89) widens, allowing more breathing room; in calm markets, it narrows, preventing outsized losses.

2. Multiplier Logic: The Square-Root Rule & Whole Numbers

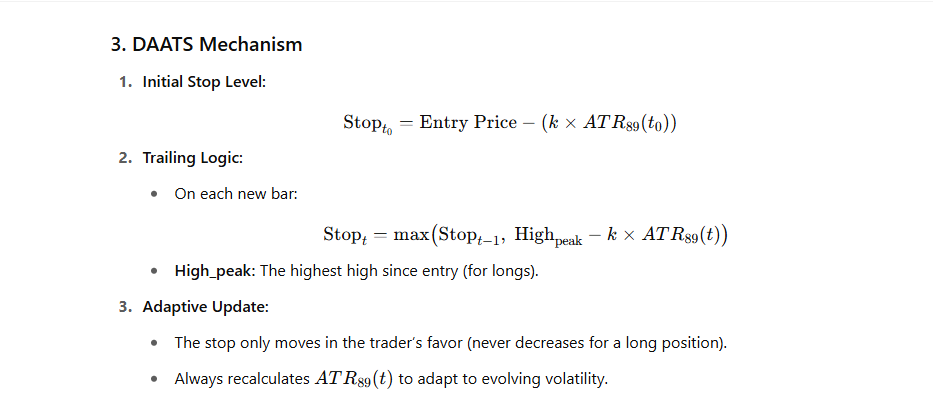

3. DAATS Mechanism

4. Practical Deployment

- Timeframes:

- M240 (4-Hour): Primary DAATS exit.

- M1440 (Daily): Secondary back-stop option using ATR-200 × 15.

- Chart Implementation:

-

- Overlay an orange trailing stop line that hugs the lower ATR channel edge.

- Trade Management:

- Enter based on GATS entry signals.

- Hold as long as price remains above trailing stop.

- Exit when price breaches the trailing stop on a close.

5. Best Practices to Avoid Whipsaws

- Confirm Trend Context: Only apply DAATS when EMA-Zone alignment and MACD filters confirm a trending environment.

- Minimum Profit Condition: Avoid stops activating within noise: e.g., require a minimum 1.5×ATR move in favor before enabling the trailing stop.

- Candlestick Confirmation: For added assurance, wait for a closing below the trailing stop rather than an intrabar breach.

- Manual Overrides: Monitor GA=SBET dynamic break-even levels for discretionary adjustments; do not let DAATS operate in isolation in choppy markets.

About the Author

Dr. Glen Brown, President & CEO of Global Accountancy Institute, Inc. and Global Financial Engineering, Inc., holds a Ph.D. in Investments and Finance and over 25 years of experience in algorithmic trading. He designed the DAATS mechanism to harmonize trailing stops with market volatility and EMA-zone structure.

Risk Disclaimer

This article is educational and not investment advice. DAATS back tests can show varying performance across regimes; always test on your markets/timeframes and consult professionals before live implementation.