-

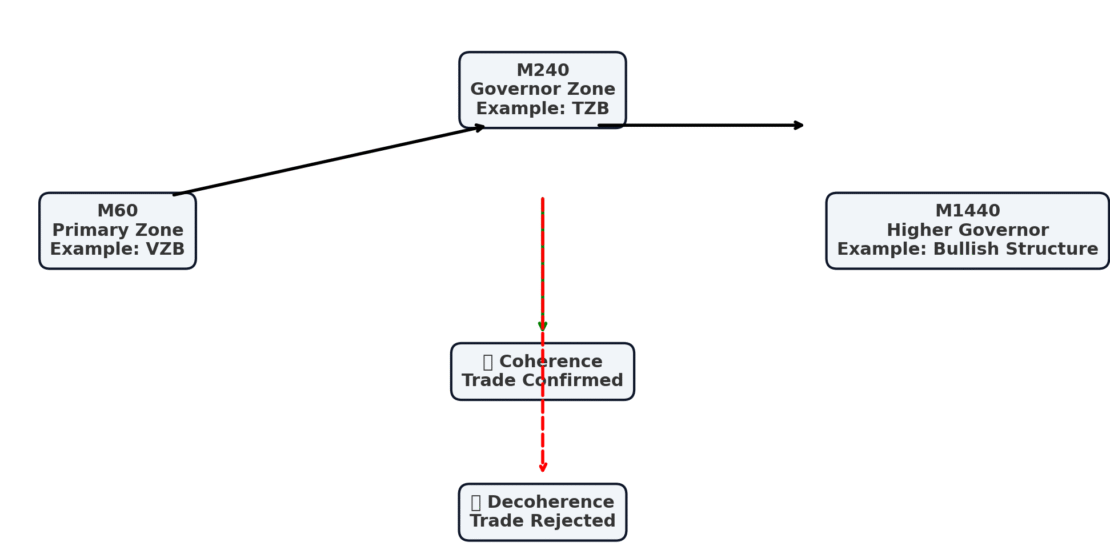

Multi-Timeframe Synergy in EZIM — Coherence Across Market Structures

- September 21, 2025

- Posted by: Drglenbrown1

- Category: Multi-Timeframe Synergy in EZIM

No Comments

Multi-Timeframe Synergy in EZIM explains how Bounces and Rejections across M60, M240, and M1440 align to create coherence and filter noise.

-

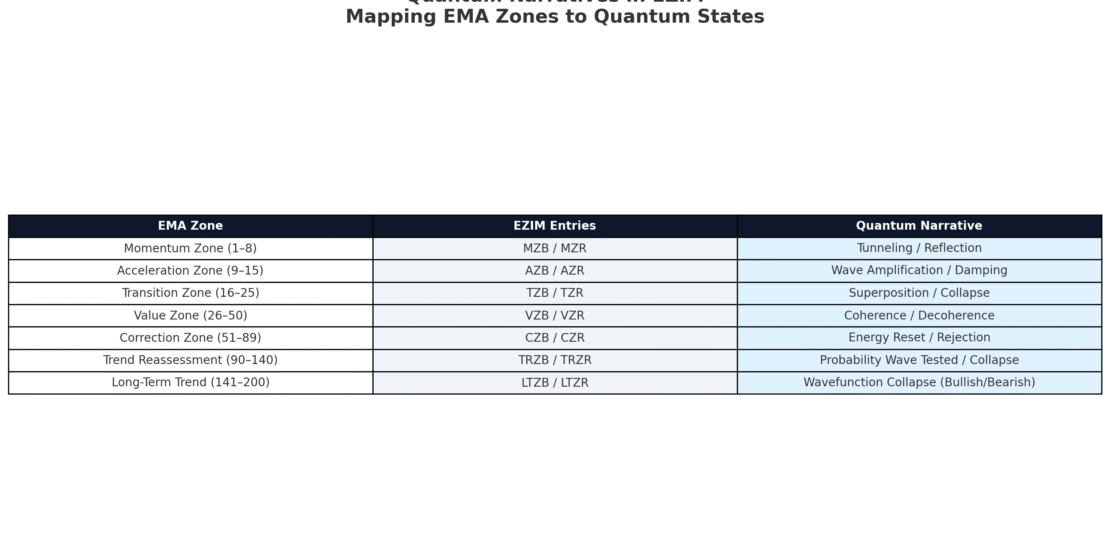

Quantum Narratives in EZIM — Mapping EMA Zones to Market States

- September 21, 2025

- Posted by: Drglenbrown1

- Category: Quantum Narratives in EZIM

-

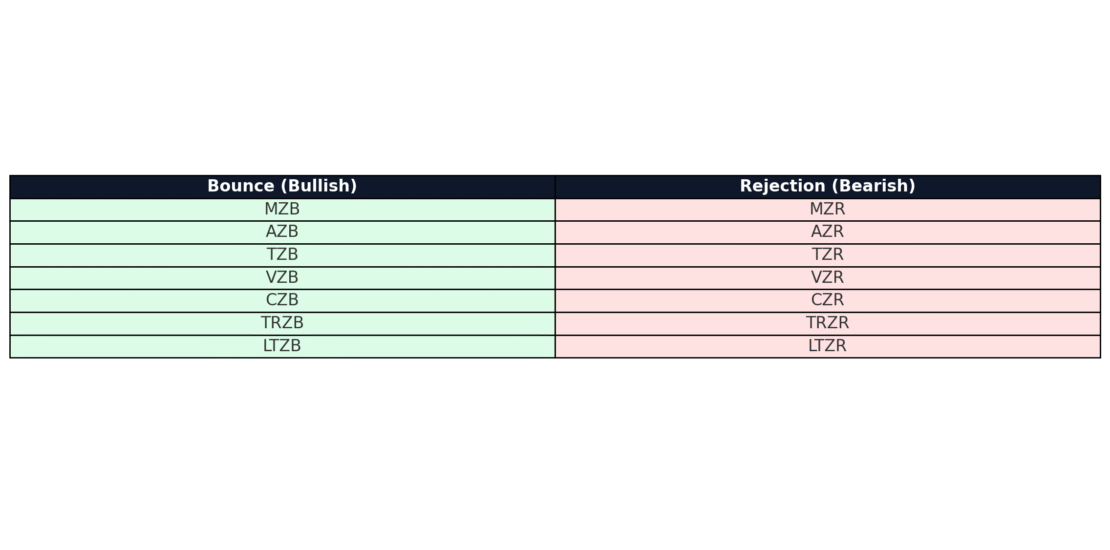

The 14 EZIM Entries — Bounce & Rejection Taxonomy

- September 14, 2025

- Posted by: Drglenbrown1

- Category: EZIM Bounce & Rejection

The EZIM 14-entry taxonomy provides traders with a structured field manual of entries across bullish and bearish market structures, linked with quantum metaphors.

-

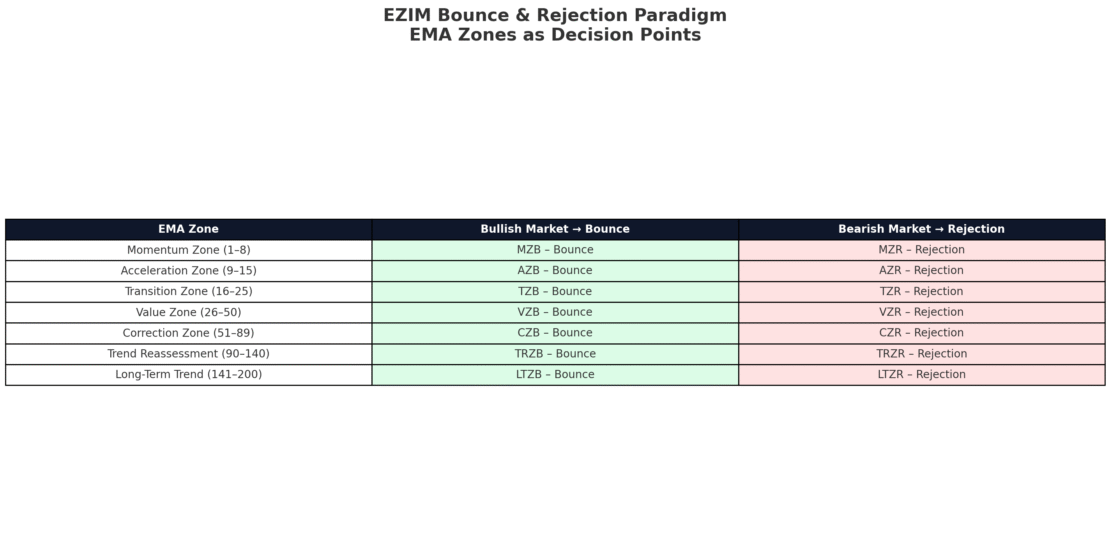

Introduction to EZIM — The Bounce & Rejection Paradigm

- September 14, 2025

- Posted by: Drglenbrown1

- Category: EZIM Bounce & Rejection

The EZIM Bounce & Rejection Paradigm classifies EMA zone interactions into bullish Bounces and bearish Rejections, creating a powerful taxonomy enriched with quantum metaphors.

-

Understanding the Value-Zone Gap (VZG): A Deep Dive into Regime Shifts, Momentum & Fair Value

- April 30, 2025

- Posted by: Drglenbrown1

- Category: Technical Analysis / Trading Strategies

“Discover the Value-Zone Gap (VZG) metric, its three states (expansion, narrowing, flip), MACD(26,50,8) signals, and volatility-weighted fair-value bands—your all-in-one guide to adaptive, multi-timeframe trading.”

-

Dow Jones (US30) Comprehensive Analysis

- April 29, 2025

- Posted by: Drglenbrown1

- Category: Indices / Market Analysis

“Comprehensive Dow Jones analysis for April 29, 2025: multi‐timeframe GATS Value-Zone envelopes, volatility-weighted fair‐value, and key fundamental catalysts for your trading roadmap.”

-

Nikkei 225 Multi-Timeframe Value-Zone Strategy & Fair-Value Analysis April 28 – May 3, 2025

- April 28, 2025

- Posted by: Drglenbrown1

- Category: Indices / Market Analysis

“Secure profits and manage risk on your April 25 Nikkei 225 long with Dr. Glen Brown’s ATR-based value-zone filters, stop strategies, and scaling plan.”

-

Gold (XAU/USD) Multi-Timeframe Value-Zone Strategy & Fair-Value Analysis April 27 – May 3, 2025

- April 28, 2025

- Posted by: Drglenbrown1

- Category: Commodities / Market Analysis

“A comprehensive week-ahead guide for trading gold: Multi-timeframe envelope tactics, volatility-weighted fair-value bands, and high-impact data events.”

-

Global Traders Guidance Sheet: EUR/USD Week of April 27 – May 3, 2025

- April 27, 2025

- Posted by: Drglenbrown1

- Category: Forex Trading / Market Analysis

“A step-by-step guide to trading EUR/USD this week: from daily value-zone envelopes and fair-value metrics to H4/M60/M30 precision entries, underpinned by major US and Eurozone data events.”

-

Adaptive Volatility Scaling in Financial Engineering: Integrating Technical Market Phases with the GATS Framework

- April 10, 2025

- Posted by: Drglenbrown1

- Category: Financial Engineering

Explore our cutting-edge methodology that combines the square root of time rule with GATS Color-Coded EMA Zones to create adaptive risk controls in financial engineering. This article delves into the theory and practical applications of dynamic volatility scaling for systematic trading.

-

Global Adaptive Statistical Break-Even Trigger (GASBET) Model

- April 4, 2025

- Posted by: Drglenbrown1

- Category: Financial Engineering

Discover the GASBET Model—a dynamic break-even trigger that integrates statistical measures with our GATS Framework. Learn how leveraging the mean and standard deviation of DAATS values optimizes exit strategies and enhances risk management.

-

Building the Future of Systematic Trading: A Comprehensive Blueprint for Global Financial Engineering

- April 2, 2025

- Posted by: Drglenbrown1

- Category: Financial Engineering

Explore the full organizational blueprint of Global Financial Engineering & Proprietary Trading Institute, where advanced financial engineering, adaptive risk management, and a dynamic units-of-allocation system combine to create an “ATM-like” proprietary trading fund.

-

Adaptive Risk Management in Action: Unlocking the Power of DAATS

- April 2, 2025

- Posted by: Drglenbrown1

- Categories:

Learn how adaptive risk management through the DAATS mechanism in the GATS Framework enhances trading performance by dynamically adjusting stop-loss levels to market volatility.

-

The Evolution of Financial Engineering: From Theory to Systematic Trading

- April 2, 2025

- Posted by: Drglenbrown1

- Category: Financial Engineering

Explore our innovative adaptive break-even mechanism for the GATS Framework, which combines dynamic percentages and fixed points to create a market-responsive exit strategy across multiple timeframes.

-

A Hybrid Adaptive Break-Even Mechanism for the GATS Framework: Integrating Dynamic Percentages and Fixed Point Thresholds

- March 27, 2025

- Posted by: Drglenbrown1

- Category: Financial Engineering

Explore our innovative adaptive break-even mechanism for the GATS Framework, which combines dynamic percentages and fixed points to create a market-responsive exit strategy across multiple timeframes.

-

GATS Framework Performance Measurement Model

- March 16, 2025

- Posted by: Drglenbrown1

- Category: Financial Engineering

Delve into our complete performance measurement model for the GATS Framework, showcasing key metrics, demo data analysis, and a data-driven approach to algorithmic trading performance, developed by Dr. Glen Brown.

-

Case Study: Navigating EURUSD with the GATS Framework – A Comprehensive Analysis of a Bullish Trade on March 12, 2025

- March 12, 2025

- Posted by: Drglenbrown1

- Category: Financial Engineering

Explore a comprehensive journey through trading strategies spanning from M1 to M43200. Discover how the GATS framework integrates adaptive, multi-timeframe approaches to capture market dynamics and optimize risk management.

-

Building a Competitive Edge: The Power of a Closed Business Model in Finance

- March 12, 2025

- Posted by: Drglenbrown1

- Category: Financial Engineering

Explore the transformative power of a closed business model in finance, where exclusive innovation and proprietary trading systems create a competitive edge for enduring success.

- 1

- 2